The Central Board of Indirect Taxes & Customs has issued an alert for taxpayers. The alert is for various divisions of taxpayers who have not filed their taxes for February. In this article, we will discuss the CBIC Issues Deadline for file GST Return filing.

CBIC Issues Deadline

The Central Board of Indirect Taxes & Customs (CBIC), responsible for administering Indirect Taxes, has issued an alert for taxpayers. The alert is for various divisions of taxpayers who have not filed for GST Return filing for February. As per the alert, these GST taxpayers require to pay their taxes before March 10, failing which they will have to spend a late fee/penalty.

Also, CBIC in multiple tweets on Monday asked these taxpayers to settle the tax amount before the deadline to avoid a late fee.

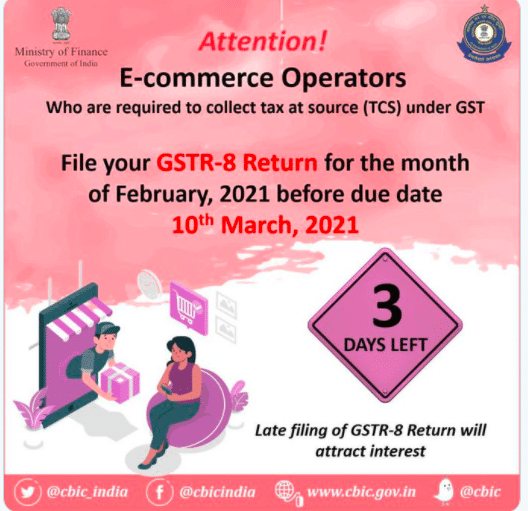

Filing of GSTR-8 Return

Asking e-commerce operators to file their tax, “Attention E-Commerce Operators who are obligated to collect Tax at Source under GST! File your GSTR-8 Return for February 2021 by March 10, 2021. Late filing of GSTR-8 Return will attract interest,” it stated.

Filing of GSTR-7 Return

Attention GST Taxpayers who are obliged to deduct Tax at Source! File your GSTR-7 Return for February 2021 before March 10, 2021. Late filing of GSTR-7 will bring late fee and interest,” the Finance ministry body for administering Indirect Taxes tweeted on Monday.

Filing of Excise Return

It also asked registered manufacturers of goods to file their Central Excise Return for February 2021 before March 10, 2021.

Further, the Ministry of Finance reminds the taxpayers that it is only two days left and its time they file their return to avoid any additional charges.

If you want any other guidance related to GST Registration please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the freshest updates narrating to your business.