Foreign Trade Policy (FTP) for 2015–2020 comprises the Merchandise Export from India Scheme (MEIS). To encourage more exports, the MEIS was established. Foreign merchants are compensated with duty credit scrips. The DGFT (Directorate General of Foreign Trade) notifies, and the Ministry of Commerce and Industry implements, the MEIS.

What is MEIS?

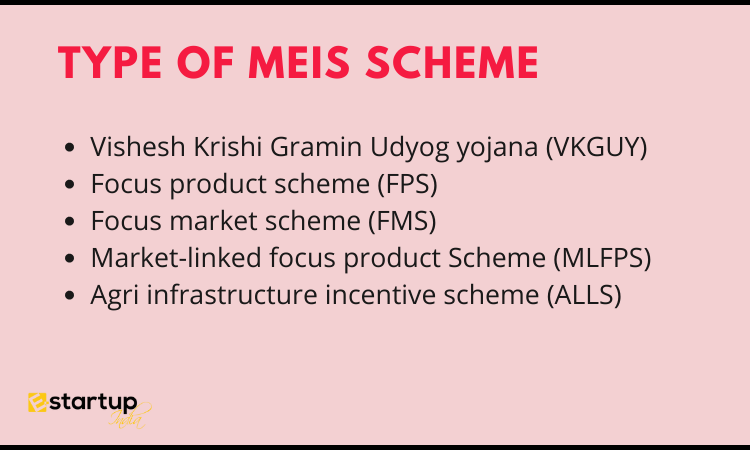

The government provides support of about 22,000 crore annually for exports under the MEIS Scheme. The previous export incentive programmes that issued duty credit scrips were superseded by MEIS. The schemes replaced include:

- Focus Product Scheme (FPS)

- Market Linked Focus Product Scheme (MLFPS)

- Focus Market Scheme (FMS)

- Agriculture Infrastructure Incentive Scrip (AIIS)

- Vishesh Krishi Gramin Upaj Yojana (VKGUY)

Exporters are eligible for a variety of benefits and bonuses under the MEIS Scheme. Exporters get these subsidies at a set rate that differs between commodities or services and nations.

Categories under MEIS

- Category A: Traditional Markets (30) – European Union (28), USA, Canada

- Category B: Emerging & Focus Markets (139) – Africa (55), Latin America & Mexico (45), CIS Countries (12), Turkey & Western Asian Countries(13), ASEAN Countries (10), Japan, South Korea, China, Taiwan

- Category C – Other Markets (70)

Important Note: To avail the MEIS Scheme, you need to submit an application form and must have an Import Export Code Registration.

One of the most popular schemes under MEIS is RODTEP Scheme. Learn about it at: RODTEP Scheme – Features, Benefits & Eligibility

MEIS applications for export service

To submit a claim for duty credit scrip benefits under MEIS, you must submit an online application using form ANF 3A and a digital signature certificate. The applicant must submit copies of the DGFT application, EDI shipping invoices, the electronic Bank Realization Certificate (eBRC), and the RCMC(Registration cum Membership Certificate). If the application is filed through an EDI port, however, the applicant should merely provide export promotion copies of non-EDI shipping invoices and evidence of landing.

If the applicant wants to use more than one port, they must submit separate applications for each one. The applicant need not provide any papers in original format, but should keep all originals for at least three years after the application has been submitted.

You can contact our experts at: 8881-069-069 to know more about the process of MEIS applications for export service.

Is GST Applicable on sale of MEIS License?

The S.No.122A Sch., which exempts EIS licences as of 13.10.2017, specifies that HSN4907 is the appropriate duty credit scrip to use. Before then, it was taxable at 5% under Schedule I to S.No.201A.

Therefore, there is no need to reverse ITC or pay GST while purchasing a licence, as the latter is exempt.

Can GST be charged while providing services abroad?

The GST Law classifies exports of goods or services as “inter-State supplies” subject to the IGST Act. Know more: GST registration mandatory for export of services in India.

Procedure for cancellation of GST registration by tax officer

moreover, If you want any other guidance relating to GST Return Filing or GST Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.