The deadline to file ITR Filing for FY 2019-20 has been extended to December 31, 2020 Though, while filing your tax return, you should do it with most care. If you make a mistake you could end up with a tax notice from the office asking you to explain the discrepancy and pay tax, if any. In this article, we will discuss on Avoid small mistakes while filling up ITR form.

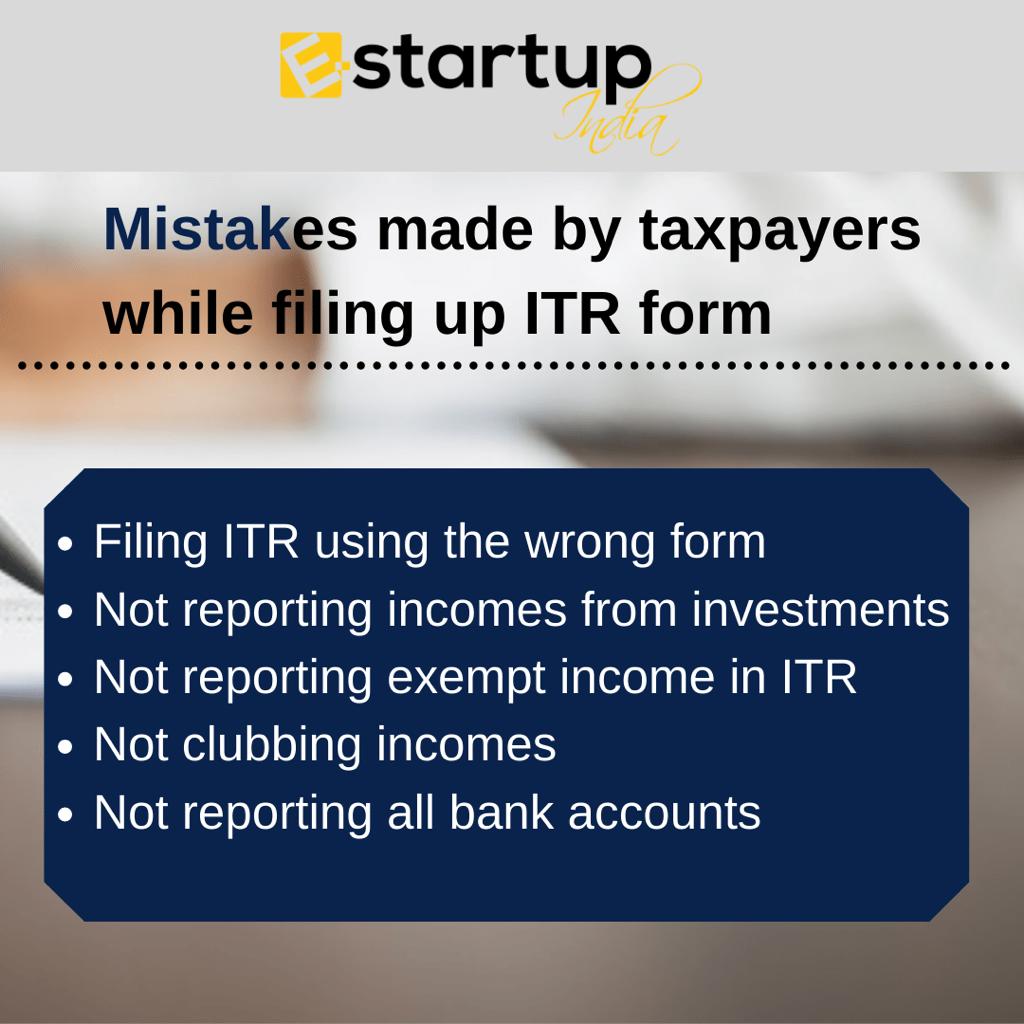

Mistakes made by taxpayers while filing up ITR form

1 Filing ITR using the wrong form

A person is needed to report all the references of income that are taxable and tax-exempt utilizing the correct ITR form applicable to him/her. If the ITR filing form is taking the mistaken form, then the return will be considered as ‘defective’. You will then have to file a modified return using the correct form.

An individual can specify which form is applicable to him for ITR Filing, depending on the sources from which income is earned in the financial year.

2 Not reporting incomes from investments

A taxpayer is compelled to report all the income from investments such as interest income from fixed deposits (FDs), capital gains arising from the sale of mutual funds or any other asset. Individuals commonly neglect to report interest obtained from a savings bank account, fixed deposits, recurring deposits, etc. They are also obliged to report and pay tax, if any, on LTCG occurring from the exchange of equity shares and equity mutual funds.

3 Not reporting exempt income in ITR

Income tax laws compel a taxpayer to report all their income, whether exempt from tax or not. It is necessary for a taxpayer to file his/her ITR if the gross income exceeds Rs 2.5 lakh or he/she satisfies certain circumstances as mentioned under the law even if the cumulative income is below Rs 2.5 lakh.

4 Not clubbing incomes

According to the Income Tax Act, there are distinct instances where the taxpayer is determined to club the income of his minor child or spouse with his income and pay taxes accordingly.

As per the requirements of the Income Tax Act, an assessee is required to mandatorily club income in specific cases with his/her total income. If an assessee does not contain the income to be clubbed in his/her ITR, the department may serve a notice to the assessee for under-reporting of income and the assessee would be accountable to pay tax, interest and penalty on the same.

5 Not reporting all bank accounts

While filing ITR for the financial year 2014-15 onwards, a taxpayer is compelled to report all the bank accounts held by him. Earlier, you were only required to mention a single bank account where you needed to receive a credit of the income tax refund if any. However, now only stagnant accounts are prohibited from the requirement of reporting in the ITR.

If you want any other guidance concerning ITR Filing, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the freshest updates narrating to your business.