This article will guide you about GST on Forward Charges by GTA. As you already know, transportation has a major role in the Indian Economy.

With roadways being the primary mode of transportation, it is responsible for the movement of a significant portion of the country’s freight and passenger traffic.

However, any disruptions in this sector can have a massive impact on the entire supply chain, making it essential to understand the key players involved in the transportation of goods. This is where Goods Transport Agencies (GTAs) come into play.

What is GTA?

An individual or entity that provides transportation services by road and provides a consignment note is defined as a Goods Transport Agency according to the Finance Act of 1994.

Hence, it is important for suppliers of transport services to have consignment notes.

Importance and Aim of Consignment Note

The issuance of a consignment note by the transporter signifies that the goods’ lien, or the right to possess the property, has been transferred to the transporter.

Consequently, the transporter assumes responsibility for the secure delivery of the consignment to the consignee.

Want to know more about GTA?

Overview of Changes in GST for Transport of Goods

The previous GST rate for the transportation of goods was either 5% without tax credit or 12% with tax credit.

To put it simply, GST is applicable to GTA services at either 5% through Reverse Charge Mechanism or 12% with Input Tax Credit through Forwarding Charge Mechanism under CGST.

However, The 47th GST Council meeting has introduced changes, allowing Goods Transport Agencies to pay GST at either 5% or 12% on their consignments under Forwarding Charge.

The option to continue with the 5% rate under reverse charge mechanism remains available, and agencies can switch from one option to another at the start of the fiscal year.

| Category | GST Rate |

| If GTA does not exercise the option to pay GST i.e., Recipient pays under the reverse charge mechanism. | 5%. The recipient can claim ITC |

| If GTA exercises the option to pay GST i.e., under the Forwarding charge. | 5% (without ITC) |

Requirements for Opting for Forwarding Charge under GST for Goods Transport Agencies (GTA)

To choose Forwarding Charge, a Goods Transport Agency (GTA) must provide a declaration before March 15 of the preceding fiscal year.

Additionally, if the GTA opts to pay GST under Forwarding Charge, the supplier must issue a tax invoice to the recipient at the applicable rate and include the declaration.

Stepwise Process for Opting Forward Charge & Filing Annexure V

- Log in to the GST portal.

- From the ‘Services’ menu, select ‘User Services’ and then ‘Opting Forward Charge Payment by GTA (Annexure V)’.

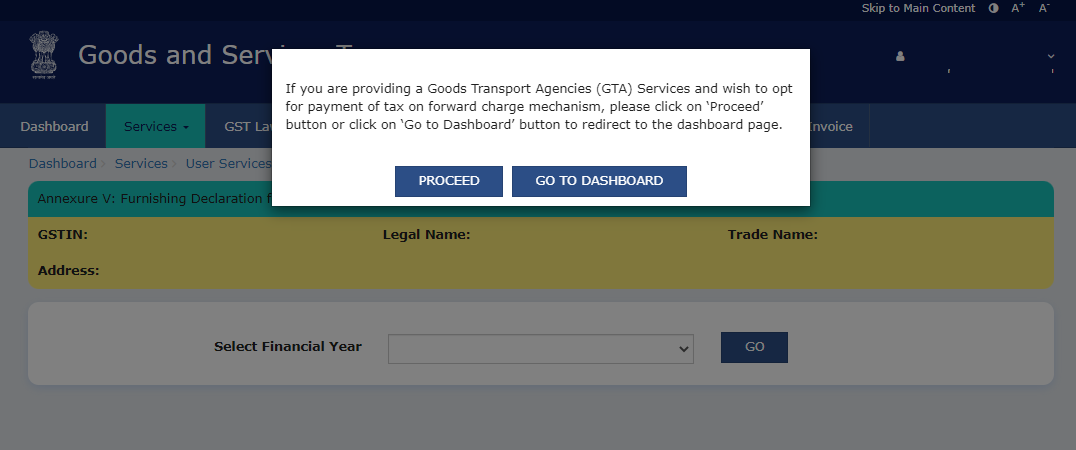

- A pop-up window will appear with two options: proceed to pay tax on a forward charge or return to the dashboard. Click on ‘Proceed’ to continue.

- Choose the financial year and click on ‘Go’.

- Select the checkboxes for both declarations and click on the ‘Proceed to file’ button located at the bottom of the Annexure V form to submit your request.

Advantages of GST on Forward Charges by GTA (Goods Transport Agency)

Choosing to pay GST on Forward Charges by GTA can have various advantages for those GTAs who have GST Registration.

As we understood above, The GTA has the option to either pay GST at a rate of 5% (without Input Tax Credit – ITC) or 12% (with ITC) on their supplies.

By opting into the forward charge mechanism, the GTA can take control of their compliance and ensure that taxes are paid on their supplies.

Furthermore, this can have a positive impact on sales as the recipient of supplies is not burdened with the task of calculating and paying the taxes.

In cases where the GTA’s vendor base is non-compliant, they can choose the 5% GST rate to avoid the complexities of claiming ITC.

How can the recipient of goods determine if a GTA is paying tax on a forward charge basis?

The answer is that if a GTA is opting to pay GST through the forward charge mechanism, it will be clearly indicated on the invoice that they issue.

You can easily create invoices for this purpose using Instabill.

Additionally, the GTA must declare in Annexure III that they have GST Registration and paying tax on a forward charge basis.

This invoice serves as evidence, and the recipient of the goods will not be required to pay tax under the reverse charge mechanism (RCM).

Is it possible for a Goods Transport Agency (GTA) to choose to pay tax on a forward charge basis for a particular GSTIN?

Yes, if a GTA is operating in multiple states, they have the option to pay tax on a forward charge basis for a specific GSTIN and pay tax under RCM(Reverse Charge Mechanism) for others.

Moreover, If you want any other guidance relating to GST Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.