The Central Board of Indirect Taxes and Customs (CBIC) has proposed a new rule to provide restrictions on utilization of the amount available in electronic credit ledger. Rule 86B is already made effective from 1st January 2021. In this article, we will discuss Rule 86B on Input Tax Credit and Its Impact In GST.

Rule 86B on Input Tax Credit

The Central Government has implemented a new rule in CGST Rules, 2017, Rule 86B, rendering for restrictions on the use of amount prepared in electronic credit ledger. This rule has already applicable from 1st January 2021 and has an over-riding effect over other rules.

It asserts that the registered person shall not use the amount available in electronic credit ledger to settle his liability towards output tax above ninety-nine per cent. of such tax liability, in cases where the amount of taxable supply other than exempt supply and zero-rated supply, in a month exceeds fifty lakh rupees. This is subject to specific restrictions and conditions of eligibility.

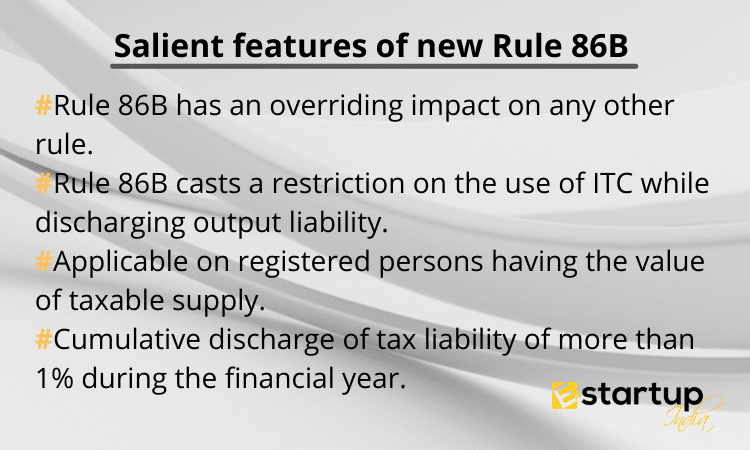

Salient features of new Rule 86B

Rule 86B (Restriction on Use of Input Tax Credit for discharging the output liability) has originated into CGST Rules, 2017. The salient features of Rule 86B are as ensues-

- Rule 86B has an overriding impact on any other rule.

- Rule 86B casts a restriction on the use of ITC while discharging output liability.

- Applicable on registered persons having the value of taxable supply.

- Cumulative discharge of tax liability of more than 1% during the financial year.

- Commissioner can able to remove the restriction after such verification.

The restriction imposed under Rule 86B

The applicable registered persons cannot use ITC above 99% of output tax liability. In simplistic words, more than 99% of the output tax liability cannot be discharged by using the input tax credit. Further exceptions such as-

- The listed person, Proprietor, Karta or any other partner paid more than Rs.1 lakh as Income Tax under Income Tax Act, 1961

- registered person under concern has obtained a refund of an amount greater than Rs.1 lakh in the preceding financial year.

- If the registered person under interest has discharged his liability towards output tax by electronic cash ledger for an amount above 1% cumulatively of the total output tax liability in the current financial year.

- If the enrolled person under Government department, Public sector undertaking, Local authority and Statutory Authority.

Impact of new Rule 86B

- The taxpayer shall compulsory required to pay 1% of the tax liability in cash despite there being balance in the electronic credit ledger.

- There will be no relation in the case of new businesses

- The restriction imposed is subject to specific conditions as discussed above.

- Restrictions inflicted by Rule 86B will further enhance the compliance burden for the taxpayers.

Moreover, you require any kind of guidance related to the GST Registration, please feel free to contact our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates reciting to your business.