Despite the fact that the government’s earlier plan to boost exports via subsidies hasn’t worked, the new tax rebate scheme for export industries have received quite good acceptance and are assisting the country’s merchandise exports to reach a record $400 billion current financial years as per the Commerce and Industry Minister. Thus, Every exporter must be aware of the New Tax Refund Scheme so that they can benefit from it. In this article, you will understand the New Tax Refund Scheme for Export Sales.

What is the RoDTEP Scheme?

RoDTEP or Remission of Duties and Taxes on Export Products is the latest scheme effective from January 1st, 2021. The scheme was launched to replace the MEIS or Merchandise Export from India Scheme.

The motive of the RoDTEP Scheme

The RoDTEP Scheme helps to ensure that exporters obtain reimbursements for previously unrecoverable embedded taxes and levies. Furthermore, The goal of the RoDTEP was to increase exports, which had previously been rather low in proportion.

Eligibility Criteria for New Tax Refund Scheme for Export Sales

- The RoDTEP Scheme is applicable to all industries, including the textiles industry. Preference should be given to industries with a high concentration of workers that benefit from the MEIS Scheme.

- Trade and manufacturing exporters equally can take advantage of the RoDTEP’s financial incentives.

- There is no precise turnover criterion to claim the RoDTEP.

- However, the scheme does not apply to items that have been re-exported. As a result, Products that originate in India are eligible for this RoDTEP’s financial incentives.

- Special Economic Zone Units and Export Oriented Units can also claim Tax Refunds.

- In cases when products have been shipped through courier from an e-commerce site, you can also utilize RoDTEP here.

- The exporter must have valid legal documents or registrations such as:

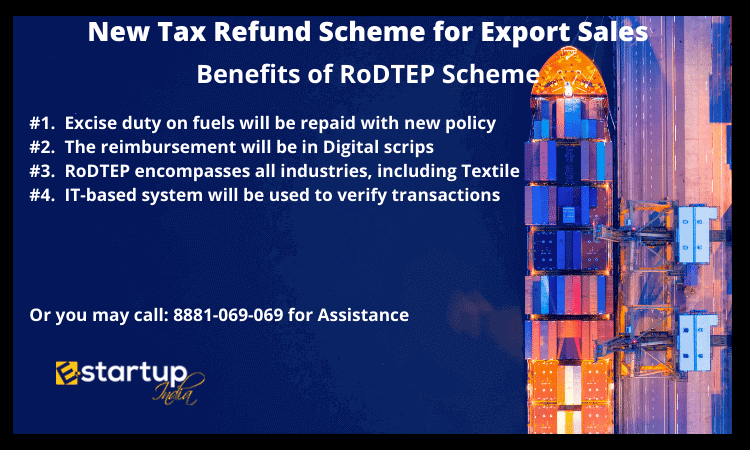

Benefits of RoDTEP Scheme

- Taxes like the Mandi tax and Central Excise duty on fuels such as VAT and coal cess will now be repaid as a result of this new policy. For the present, the RoDTEP Scheme covers everything covered by the MEIS and the RoSTCL (Rebates of State and Central Taxes and Levies).

- The reimbursement will be in the form of digital scrips. In order to keep track of these duty credits, an electronic ledger will be used.

- The approval process has been sped up significantly due to the online platform. An IT-based risk management system will be used to verify the exporter’s records to guarantee that transactions are processed quickly and accurately.

- RoDTEP encompasses all industries, including textiles, to maintain standardization across the market. Furthermore, a committee will be formed to determine how the scheme will be implemented throughout the various sectors, how much benefit each sector would receive, and other relevant issues

Commerce & Industry Min. on New Tax Refund Scheme for Export

However, even though the government has decreased export subsidies, India will witness a great accomplishment in exports in Financial Year 2022, according to the minister.

Trade-in merchandise was $334 billion as of January, surpassing the previous yearly record of $330 billion (in FY19). According to Goyal, “we are well on pace to reach over $400 billion exports in the present year.

He further adds, the states notify taxes, cess, and/or tariffs on the product, and we refund those states. Since most goods and services are taxed by the national govt, the GST is immediately reimbursed to exporters.

Moreover, you require any kind of guidance related to the IEC code, please feel free to contact us at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.