GST is known as one of the most beneficial revolutions for the Indian economy as per the Indian Government. It has subsumed multiple indirect taxes such as excise, VAT, and service tax. This article discusses the benefits of GST Registration under law.

What is GST?

GST stands for Goods and Services Tax. It is imposed on the sale or supply of goods and services. It is destination based tax and imposed on all the stages. From the point of manufacturing to find consumption of the product or service, GST is applicable.

However, the final consumer has to bear the tax burden as at previous stages the option of setting off taxes is available for businesses having GST Registration online .

The process of submitting taxes is known as GST Return Filing. In the GST Return Filing process, the taxpayers submit the taxes, set off taxes and share the data of their business transactions to calculate the tax liability.

Therefore, GST is beneficial for everyone including customers, businesses as well as the government.

You can understand GST and GST Return Filing easily through reading our guides at:

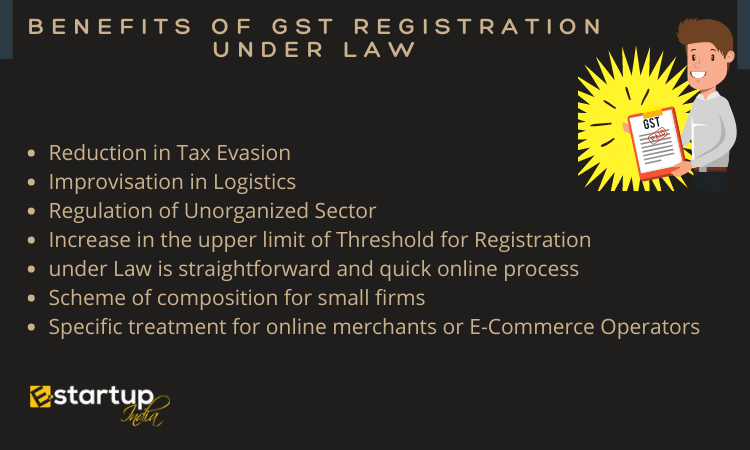

Benefits of GST Registration under Law

Reduction in Tax Evasion

GST is online completely. Furthermore, Only if the supplier includes the correct information in a return does the input credit apply to the beneficiary, such as producers or service providers. This helps the providers of goods and services and, in turn, helps reduce tax evasion.

Improvisation in Logistics

Logistics efficiency has increased as a result of the adoption of the GST, which has lowered barriers to the free flow of products between states. Due to the GST, warehouses are locating their units in important cities as opposed to every other city.

Regulation of Unorganized Sector

Earlier, there was little regulation of the unorganized sectors such as textile and construction sectors. There are several provisions for online payments and compliances under GST. Thus, these sectors have also been regularized.

Learn more at: GST Rates on Construction Materials. & A Complete Guide to GST on Garments

Increase in the upper limit of Threshold for Registration

Previous tax legislation made businesses with a turnover of more than 5 lakh rupees liable for paying VAT. Besides, The threshold limit for VAT Registration varied across states. However, it has been increased to 20 lakh rupees under the GST regime. As a result, small businesses or GST Registration for MSME Sector has become a boon as they can easily conduct their business operation without having to mandatory obtain GST Registration. However, these businesses can also voluntarily have online GST Registration and avail the benefits of GST Registration under the law.

GST Registration under Law is straightforward and quick online process

The whole GST procedure is completed online and is quite straightforward, from registration to filing returns. This has been advantageous for start-ups in particular since it saves them from having to go from one registration to the next for things like VAT, excise, and service tax.

Read about the complete procedure at: How to get GST Registration if I am starting a new online business

Scheme of composition for small firms

Small firms (with a turnover of between 20 and 75 lakh rupees) might profit from the GST since it offers the possibility to reduce taxes by employing the Composition scheme under online gst registration. The tax and regulatory burden for many small firms has decreased as a result of this initiative.

Specific treatment for online merchants or E-Commerce Operators

Before the implementation of the GST system, the act of selling items online was not regulated. The VAT legislation changed often as per the state. However, with the introduction of GST the rules and regulations have been made clear for online merchants or E-Commerce Operators. GST has also enabled ease of doing business for entrepreneurs doing business through e-commerce mode.

Conclusion

In Conclusion, the benefits of GST Registration under law are several. If you are eligible for GST Registration in India, you must get it and avail its several benefits. Multiple businesses have become successful and are able to boost their growth through the implementation of GST. If you require any further guidance on GST Registration, GST Modification etc., please contact us at: 8881-069-069.

Moreover, If you want any other guidance relating to GST Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.